Another surprise from the British electorate…

For the second time in 12 months all the predictions were wrong. Political commentators and the City’s elite were wrong footed and the currency markets reacted immediately. So much for strong and stable, we now have a “weak and wobbly” hung parliament which is the exactly the opposite of Theresa May’s goal and the UK’s expectation when the snap election was announced.

It is absolutely not the certainty that business leaders had sought in the run-up to Brexit negotiations. Before yesterday’s poll, Sterling ticked higher amid growing confidence that Theresa May would secure a majority. For the vast majority in the City the question was not whether the Conservatives would secure a majority, but whether you should bet on it being 80, 90 or even 100 seats.

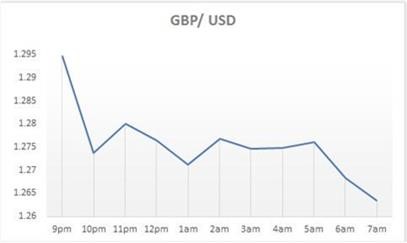

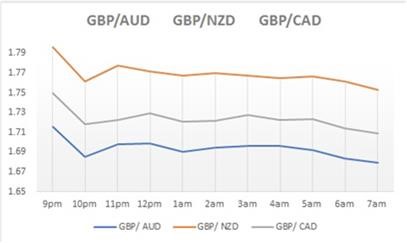

It was not surprising then that Sterling fell sharply as the charts below illustrate. As the exit poll was announced, Sterling dropped 1.5% against the US Dollar, 2.3% against the Euro, 1.7% against the Canadian Dollar, 1.8% against the Aussie Dollar and 2.6% against the NZ Dollar.

Sterling experienced a similar, sharp, severe decline after Brexit but had managed a mild recovery this year. This situation is different. This situation could run and run and the permutations are frightening for the UK and Sterling.

Will Theresa May still be Prime Minister? Who will form the Government? Is there going to be a minority Government and how long will it last? Could there be another referendum this year? What sort of Brexit deal will be agreed? EU commissioner Gunther Oettinge has already said he expects Brexit negotiations to be delayed.

All these factors, and there more, add to the uncertainty and the currency markets do not like uncertainty. If you have currency to buy and sell, the only way to avoid this uncertainty is to trade now.

Where do we go from here? Well, as soon as the hung parliament result was announced, speculation increased that the Conservatives and the DUP would form a coalition government Sterling has stabilised a little however, investors in Asia are in no hurry to rush to Sterling’s aid.

If you have currency to buy or sell, please contact us on +44 (0) 1491 577 550 or John Mason FX for more information.